Anti-Money Laundering – Online Training

Anti-Money Laundering Overview:

Our full suite of interactive video-based online courses can be white labelled and distributed by you.

Money-Laundering is a major criminal problem, worldwide. This course starts by defining money laundering and describing the ‘regulated sector’ as defined by the Proceeds of Crime Act.

The online Anti-Money Laundering E-Learning course discusses a number of money-laundering offences, including tax evasion, theft, fraud, bribery and the financing of terrorism.

You’ll learn about some of the ‘red flags’ which could indicate illegal activity, and the connections between money-laundering and certain financial institutions. You’ll see how the regulated sector combats money-laundering through compliance, due diligence, and record-keeping.

Finally, the online Anti-Money Laundering course examines companies’ internal controls and monitoring to fight against money-laundering, including policy statements, effective reporting systems, and staff responsibilities.

Anti-Money Laundering Target Audience

This online Anti-Money Laundering E-Learning course is suitable for anyone working in an organisation that handles large amounts of money. The online Anti-Money Laundering course can also be used as an introduction to the subject for those working or planning to work in a regulated sector.

Anti-Money Laundering Advantages

Training staff in Anti-Money Laundering can be used as part of a company’s proof that they are actively working to identify and discourage money-laundering

CPD approval means that this course can be used by those that need to prove they are continually developing themselves.

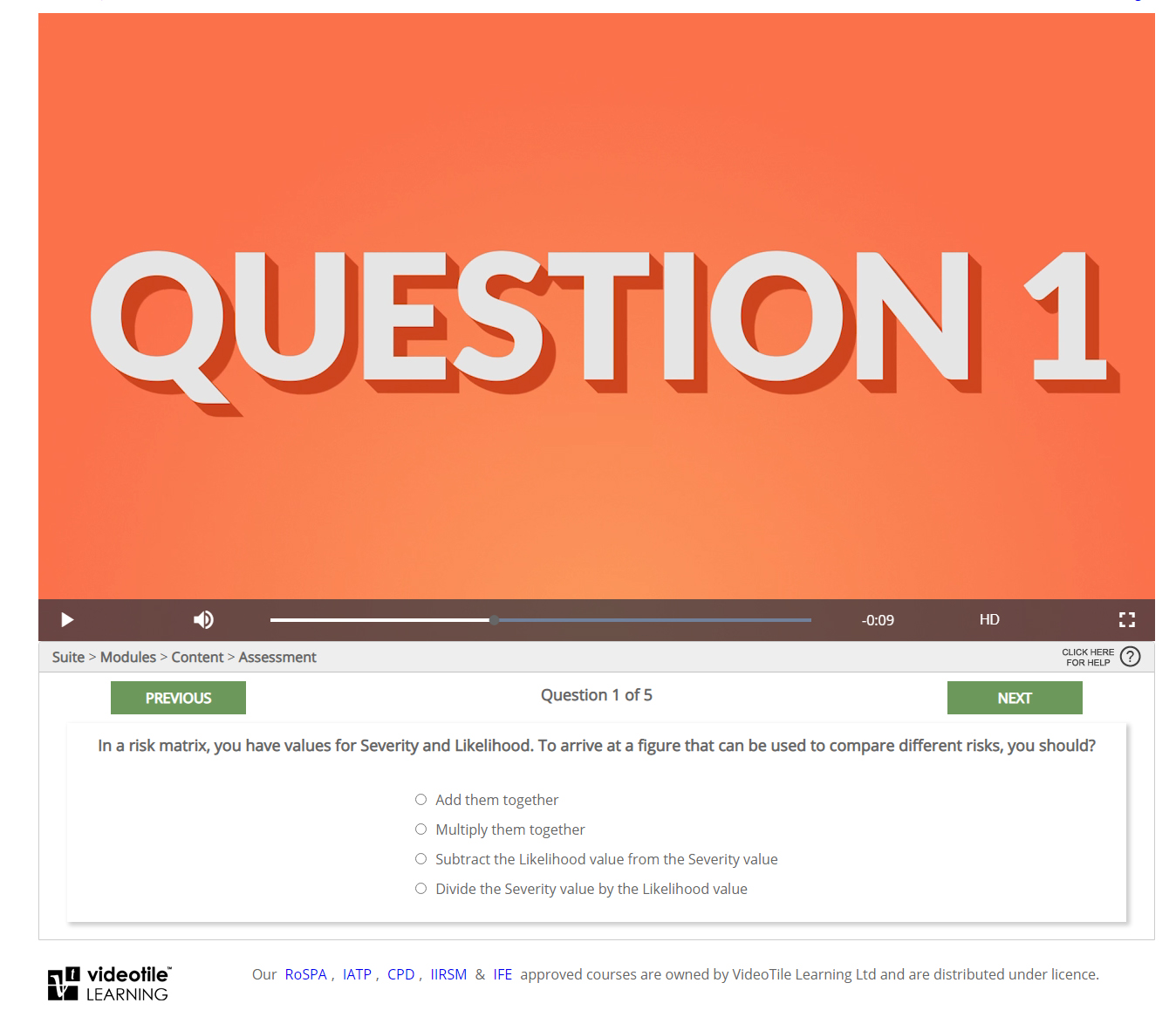

Online training is flexible, efficient, and cost-effective, meaning the candidate can progress through the modules at their own pace and in their own time to fit the training in around their work and personal life.

Duration of the course

50 minutes

Anti-Money Laundering Modules

Introduction

The Law

Money-Laundering

Due Diligence

Internal Controls and Monitoring